how do you calculate cash flow to creditors

Cash flow from financing activities CFF is the net flow of cash between the company and its owners creditors and investors. Net new borrowing The formula of cash flow to How do you calculate cash flow to creditors if you are.

Account Payable Vs Accrued Expense Top 6 Differences To Learn Accounts Payable Accounting Basics Accounting

Get 3 cash flow strategies to stop leaking overpaying and wasting your money.

. Use this simple finance cash flow to creditors calculator to calculate cash flow to creditors. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Rated the 1 Accounting Solution.

Ad QuickBooks Financial Software. The formula of cash flow to creditors interest paid - net new borrowing. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating activities in a period and is displayed on the Cash.

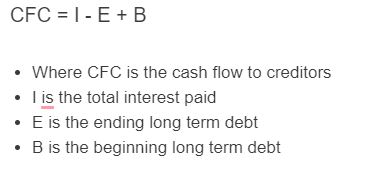

E Ending Long Term Debt. This is a simple example of. SOLVED You have been given the following information about the production of Usher Co and are asked to provide the plant manager with information for a Accounting.

Where I Interest Paid. The direct method lists and adds all of the cash transactions including payroll. Ad Our Resources Can Help You Decide Between Taxable Vs.

Ad The Key To Success Is Gaining More Control Over Cash Flows. It reflects the companys financing mix. B Beginning Long Term Debt.

Based on these numbers we can calculate operating cash flow as follows. Rated the 1 Accounting Solution. Ad 93 of small business owners are constantly leaking money on useless and unnoticed things.

Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes. The formula of cash flow to creditors interest paid - net new borrowing. Speak To An HSBC Representative To Learn More About Our Commercial Banking Services.

Lets look at a simple example together from CFIs Financial Modeling Course. Ad QuickBooks Financial Software. Net new borrowing asks for ending.

Start calculating operating cash flow by taking net income from the. The available balances on your credit cards do not count as free cash flow what you spend using credit cards translates into negative cash. HSBC Can Help You With That.

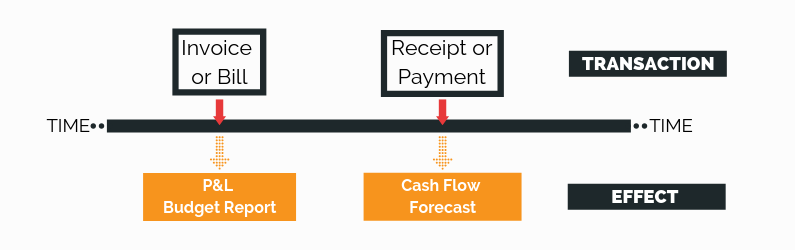

Cash flow to creditors can help you comprehend the condition of your company and whether you have the ability to borrow money from investors at times of debt. How do you calculate cash flow to creditors if you are not given long term debt. There are two different methods that can be used to calculate cash flow.

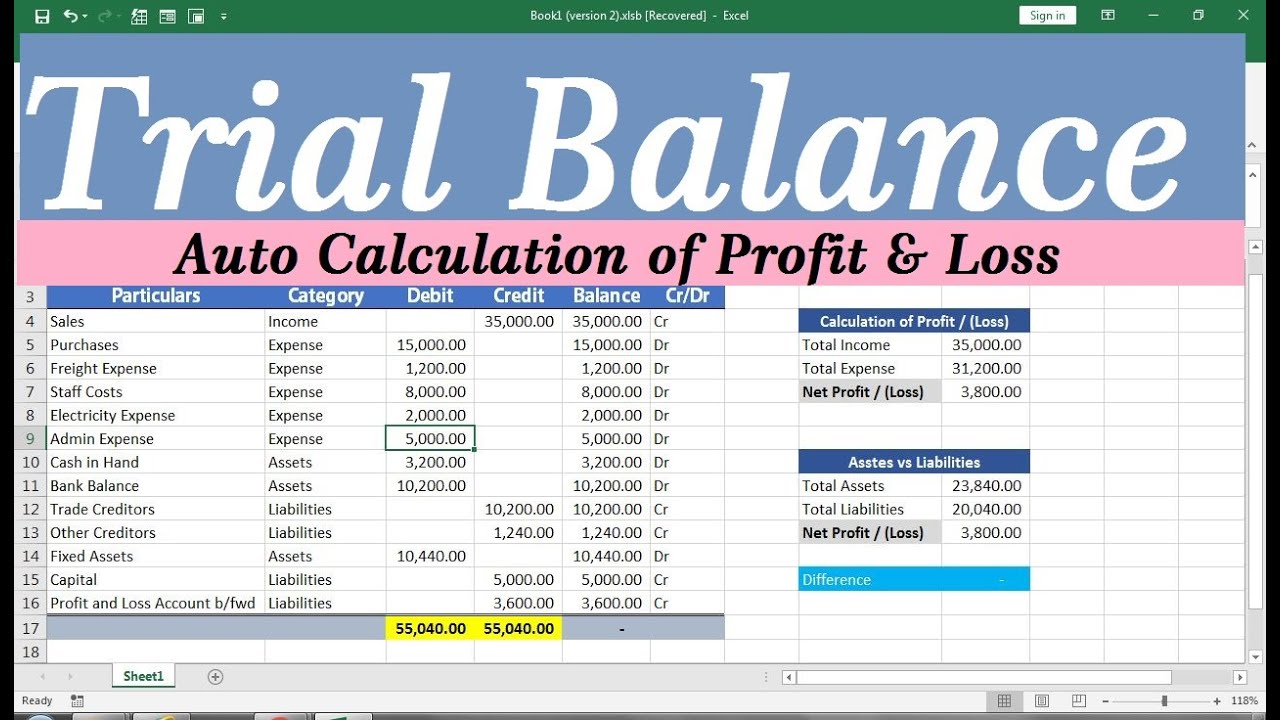

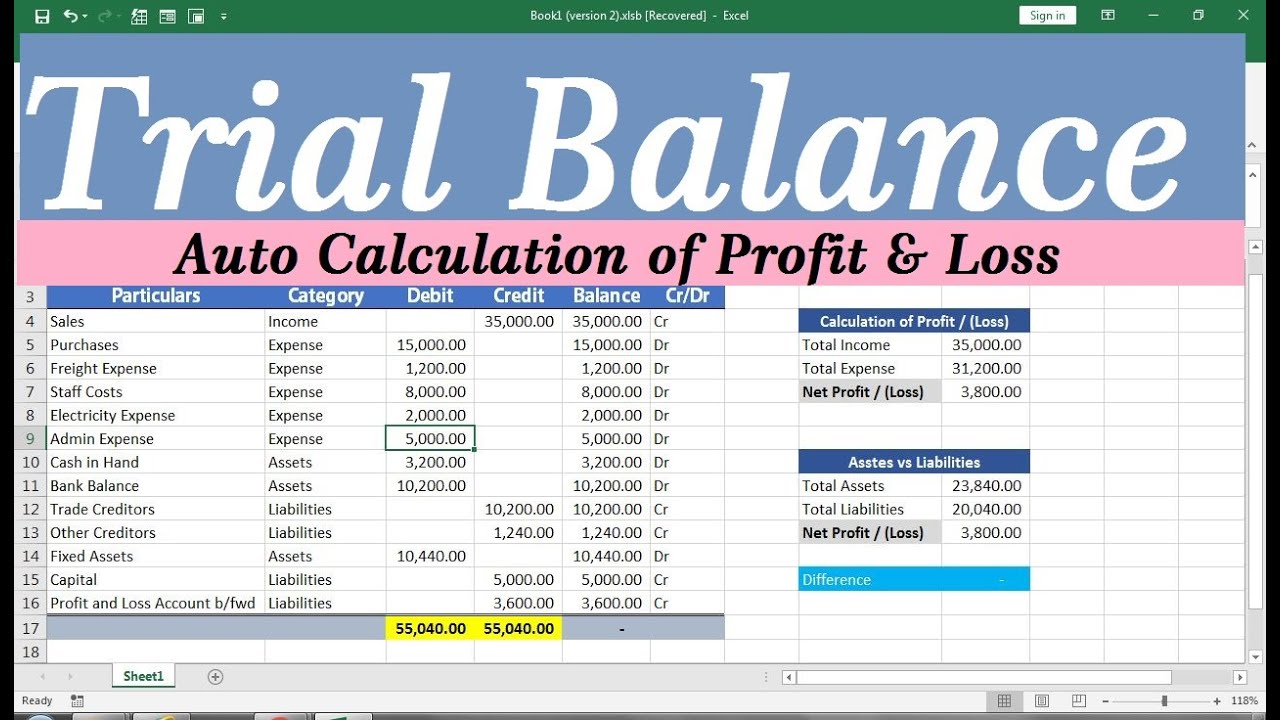

The formula for free cash flow can be derived by using the following steps. Cash Flow to Creditors I - E B. Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B.

The Trial Balance Trial Balance Accounting Basics Accounting

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano

Branches Of Accounting Accounting Jobs Bookkeeping Business Accounting And Finance

Debtor Vs Creditor Restructuring And Supplier Financing

Training Financial Modeling Fundamentals Working Capital Debtors Modano

Debtors And Creditors Control Accounts Accounting Basics Financial Peace University Accounting

Timing Of Debtor And Creditor Payments Calculation In Calxa

Cash Flow To Creditors Calculator Calculator Academy

Cash Flow To Creditors Calculator Calculator Academy

How To Prepare Projected Balance Sheet Accounting Education Balance Sheet Accounting Education Accounting Principles

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano

Blank Income Statement Template Fresh Blank In E Statement And Balance Sheet Aoteamedia Statement Template Income Statement Mission Statement Template

How To Make Profit And Loss Account And Balance Sheet In Excel Balance Sheet Trial Balance Balance

The Accounting Equation Is The Best Methods In Principle Of Accounting Learn Accounting Accounting Basics Accounting Education